The Indian Income Tax Department issues a 10-digit alphanumeric identification number known as a Permanent Account Number (PAN). It serves as an essential document for financial transactions and is applicable to individuals, companies, Hindu Undivided Families (HUF), and other taxpayers. The PAN card has lifetime validity and is a critical tool for tax-related purposes.

Ways to Apply for a PAN Card

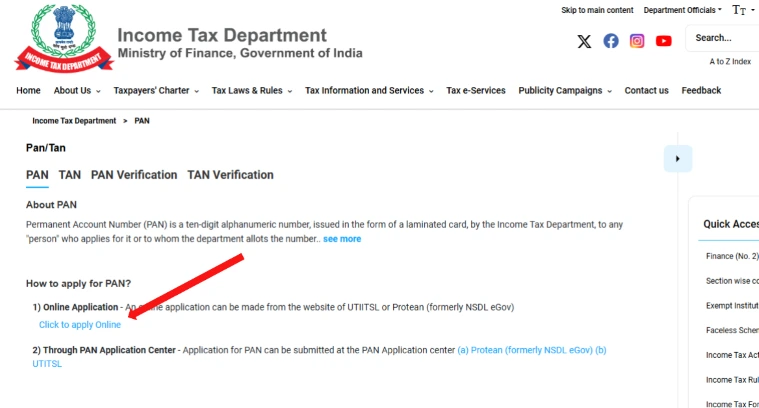

A PAN card can be applied for online or in person. Additionally, requests for updates or corrections to PAN details can also be made online. Opting for the online application process is often considered more convenient. It involves filling out an application form, paying the required fee digitally, and mailing the necessary documents to NSDL or UTIITSL for verification.

READ ALSO: How to Claim House Rent Allowance (HRA) Tax Benefits: Key Documents and Practices to Keep in Mind

Steps to Apply for a PAN Card Online

There are three main platforms to apply for a PAN card online:

- Income Tax Department Portal (Instant e-PAN)

- NSDL Website

- UTIITSL Website

Both NSDL and UTIITSL are authorized by the Government of India to handle PAN-related services.

Documents Required for PAN Application

The following paperwork must be included with your application:

- Identity proof

- Address proof

- Date of birth proof

- Registration certificates (for companies, HUFs, firms, or associations)

For a detailed list of acceptable documents, visit the official PAN websites.

Instant PAN Application via Income Tax Portal

Eligible individuals with a valid Aadhaar number can obtain an e-PAN instantly without completing a lengthy application. Here’s how:

- Visit the Income Tax Portal: Select the ‘Instant e-PAN’ option.

- Choose ‘Get New e-PAN’: Enter your Aadhaar number and proceed.

- Authenticate with OTP: Verify using the OTP sent to your Aadhaar-linked mobile number.

- Review Details: Confirm personal details fetched from Aadhaar and validate your email ID.

- Receive Confirmation: An acknowledgment number will be sent, and the e-PAN will typically be available for download within 10 minutes.

If you wish to receive a physical copy, additional fees may apply.

Note: Instant e-PAN is available only for Indian citizens aged 18 and above with Aadhaar-linked mobile numbers. Non-resident individuals (NRIs), companies, trusts, and other entities cannot use this service.

READ ALSO: Best Credit Cards for Daily Use in India 2024

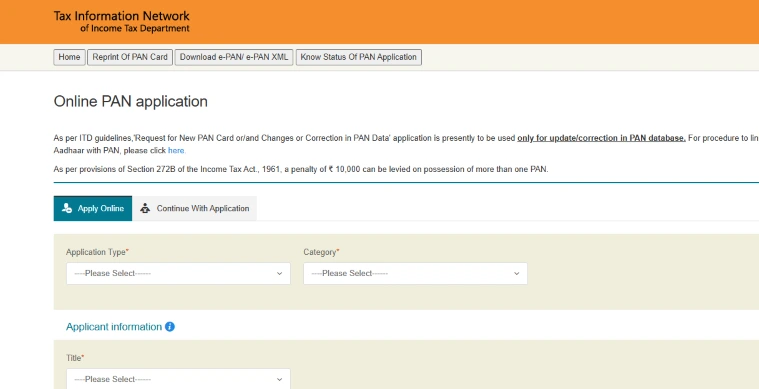

Applying via NSDL Website

Follow these steps to apply for a PAN card on the NSDL website:

- Visit the NSDL portal and choose the appropriate application type (Form 49A for Indian citizens or Form 49AA for foreign citizens).

- Complete the application form with personal and contact details.

- Submit documents and payment online or select the physical submission mode.

For physical submissions, mail the acknowledgment form and required documents to:

Income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune – 411045

- The PAN card will be sent to your email or physical address within 15-20 days.

PAN Card Applying via UTIITSL Website

- Access the UTIITSL portal and select the relevant PAN card application type.

- Provide details such as personal information, contact details, and address.

- Upload documents and complete the application process.

- For physical applications, send the completed form and attachments to the nearest UTIITSL office.

The PAN card is generally processed and dispatched within 15 days.

Offline PAN Card Application

- Obtain and complete Form 49A or Form 49AA from the nearest PAN center or download it from the official website.

- Attach required documents, including photographs and signatures.

- Submit the form and pay the applicable fees at the PAN center.

- Track the status of your application using the given acknowledgment number.

Within 15 days following verification, the Card will be issued.

Automatic PAN for Companies

The Ministry of Corporate Affairs (MCA) has integrated PAN allotment with company incorporation. Companies and LLPs no longer need to apply separately for a PAN card as it is issued automatically upon registration.

PAN Application Fees

The application fee depends on the mode of submission and delivery:

- e-PAN: Rs. 66–72

- Physical PAN in India: Rs. 101–107

- Physical PAN outside India: Rs. 1,011–1,017

Making Changes or Corrections in PAN Card

You can apply for updates or corrections to your PAN online via NSDL or UTIITSL. Submit supporting documents for the changes, pay the processing fee, and expect the updated PAN within 15 days.

With digital advancements, obtaining a PAN has become quick and straightforward. Whether you apply online or offline, having this critical document ensures seamless financial and tax-related transactions.

PAN Card FAQ: Everything You Need to Know

1. What is a PAN Card?

A PAN (Permanent Account Number) card is a unique, 10-digit alphanumeric identifier issued by the Indian Income Tax Department. It is essential for conducting financial transactions and is applicable to individuals, companies, Hindu Undivided Families (HUFs), and other taxpayers. The PAN card has lifetime validity.

2. How can I submit a PAN card application?

There are two ways to apply for a PAN card: online and offline. Online applications are quicker and easier, while offline applications involve submitting physical forms. Applications can also be made for updates or corrections to existing PAN details.

3. What documents are required for a PAN card application?

The following documents are required:

- For individuals: Proof of identity, proof of address, and proof of date of birth.

- For companies, firms, or associations: Registration certificate.

- For trusts: A copy of the trust deed or registration certificate.

- For foreign citizens: Proof of identity and address.

4. How can I apply for a PAN card online?

A PAN card can be applied for online using:

- Income Tax Portal (Instant e-PAN)

- NSDL Website

- UTIITSL Website

Each platform has a distinct process, as explained below.

5. How do I apply for an Instant e-PAN on the Income Tax Portal?

If you have a valid Aadhaar card, follow these steps:

- Visit the Income Tax Portal and select the ‘Instant e-PAN’ option.

- After selecting “Get New e-PAN,” input your Aadhaar number.

- Use the OTP that was issued to your Aadhaar-connected cellphone number to confirm.

- Confirm your details and validate your email ID.

- After successful verification, you will receive your e-PAN within 10 minutes.

Note: This service is only available to Indian citizens aged 18 and above with Aadhaar-linked mobile numbers.

6. How can I apply for a PAN card via the NSDL website?

Follow these steps:

- Visit the NSDL portal and select the appropriate application type (Form 49A for Indian citizens or Form 49AA for foreign citizens).

- Complete the form with personal and contact details.

- Submit the form, upload documents, and pay the application fee online.

For physical submissions, mail the acknowledgment form and documents to:

Income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune – 411045

The PAN card will be dispatched within 15–20 days.

7. How can I apply for a PAN card through UTIITSL?

To apply through UTIITSL:

- Visit the UTIITSL portal and select the relevant application type.

- Provide the required personal, contact, and address details.

- Upload the necessary documents.

- Pay the application fee.

- For physical submissions, send the completed form to the nearest UTIITSL office.

It will take 15 days to issue the PAN card.

8. How can I apply for a PAN card offline?

- Download and print Form 49A or Form 49AA from the NSDL or UTIITSL website, or collect it from a PAN center.

- Fill out the form, attach required documents, and affix your photograph.

- Submit the form to the nearest PAN center along with the application fee.

- Track your application using the acknowledgment number provided.

The PAN card will be processed and issued within 15 days.

9. What is the fee for a PAN card application?

The fees depend on the type of application and delivery method:

- e-PAN (paperless): Rs. 66–72

- Physical PAN within India: Rs. 101–107

- Physical PAN outside India: Rs. 1,011–1,017

10. How can I update or correct details in my PAN card?

To make changes or corrections:

- Visit the NSDL or UTIITSL website.

- Select the application type as “Changes/Corrections in existing PAN”.

- Fill in the necessary details and upload supporting documents.

- Pay the applicable processing fee.

The updated PAN card will be dispatched within 15 days.

11. Can companies automatically receive a PAN card during incorporation?

Yes, the Ministry of Corporate Affairs has integrated PAN allotment with company registration. Companies and LLPs automatically receive their PAN as part of the incorporation process.

12. How long does it take to get a PAN card?

- Instant e-PAN: Approximately 10 minutes (for individuals with valid Aadhaar).

- Regular PAN application: 15–20 days (via online or offline methods).

13. Is it possible to apply for a PAN card for free?

Yes, Indian citizens applying for an instant e-PAN through the Income Tax portal can obtain it for free. Other modes of application involve a fee.

14. How can I track the status of my PAN card application?

You can track your PAN card application status using the acknowledgment number provided at the time of application. Status updates are available on the NSDL and UTIITSL websites.

15. What should I do if I have multiple PAN cards?

Having multiple PAN cards is against the law. You must surrender duplicate PAN cards to the Income Tax Department.