HDFC Bank is one of India’s leading financial institutions, renowned for offering a diverse range of credit cards tailored to meet the unique needs of its customers. Whether you’re a frequent traveler, a shopaholic, or someone looking for financial flexibility, HDFC credit cards provide a perfect mix of rewards, cashback, and exclusive privileges. Designed with user convenience and lifestyle enhancement in mind, these cards cater to a variety of spending habits while offering top-notch security and ease of use. With features like reward points, fuel surcharge waivers, lounge access, and attractive discounts, HDFC credit cards have become a popular choice among millions of customers across the country.

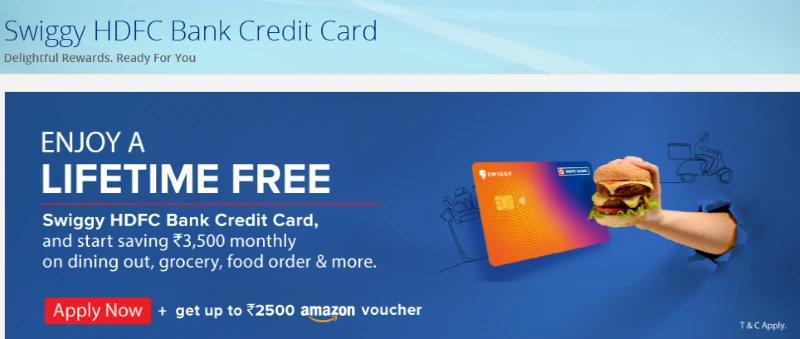

HDFC Swiggy Credit Card

The HDFC Swiggy Credit Card is a co-branded offering that brings together the trusted financial services of HDFC Bank and the convenience of Swiggy. Designed for food lovers and online shoppers, this card offers a range of benefits tailored to enhance your lifestyle. Here’s a detailed breakdown of its features, eligibility criteria, and associated fees and charges.

Read Also: Best Credit Cards for Daily Use in India 2024

HDFC Swiggy Credit Card: Apply Now

Features of the HDFC Swiggy Credit Card

- Cashback Benefits

- 10% Cashback on Swiggy app services, including food delivery, Instamart, Dineout, and Genie.

- 5% Cashback on online spending across eligible merchant categories (MCCs).

- 1% Cashback on other transactions (with some exclusions and caps).

- Swiggy One Membership

- Complimentary Swiggy One Membership for 3 months upon card activation. This subscription provides free deliveries and exclusive discounts on select restaurants, Instamart, and Genie orders.

- Activation and Redemption

- Activate the card through a transaction, PIN setup, or enabling online and international transactions.

- Claim the Swiggy One Membership via the Swiggy app 2-3 days after activation.

- Other Features

- Zero Liability for Lost Cards: There is no responsibility for fraudulent transactions if the card is reported as lost without delay.

- Interest-Free Period: Up to 50 days of interest-free credit from the purchase date (conditions apply).

- Revolving Credit: Flexibility to pay a nominal interest rate for revolving credit.

- Smart EMI Facility

- Convert high-value purchases into manageable EMIs for stress-free repayments.

- Contactless Payments

- Enjoy secure and convenient payments for transactions up to ₹5,000 without entering your PIN.

- Golf Privileges

- Complimentary access to golf courses, lessons, and discounts on additional services.

HDFC Swiggy Credit Card: Apply Now

Eligibility Criteria

For Salaried Individuals

- Age: 21 to 60 years.

- Income: Minimum monthly net income of ₹15,000.

For Self-Employed Individuals

- Age: 21 to 65 years.

- Income: Minimum ITR of ₹6 lakh per annum.

HDFC Swiggy Credit Card: Apply Now

Fees and Charges

- Joining and Renewal Fees

- ₹500 plus applicable taxes.

- Renewal fee waived if you spend ₹2,00,000 or more in a year.

- Festive Lifetime Free Offer

- Apply between October 1, 2024, and December 31, 2024, via digital or physical channels to enjoy a lifetime free card (terms apply).

- Exclusions for Renewal Fee Waiver

- Certain transactions such as cash withdrawals, balance transfers, and cash-on-call are excluded from the spend calculation.

- Smart EMI Charges

- Balance Transfer on EMI: 1% of the loan amount (minimum ₹250, exclusive of GST).

HDFC Swiggy Credit Card: Apply Now

Additional Information

- Cashback earned will be credited as statement credit starting June 21, 2024.

- Transactions using Swiggy Money Wallet, Swiggy Minis, and Swiggy Liquor are not eligible for cashback.

- For detailed terms and conditions, refer to the card member agreement.

HDFC Swiggy Credit Card: Apply Now

How to Apply?

Apply online via HDFC Bank’s digital platform or through physical application. Don’t miss the festive offer for a lifetime free card!

For more details or assistance, contact HDFC Bank’s customer service at 1800 102 6263.

Enhance your lifestyle with exclusive rewards, cashback, and premium privileges through the HDFC Swiggy Credit Card. Apply now and start enjoying the benefits!

Read Also: How to Claim House Rent Allowance (HRA) Tax Benefits: Key Documents and Practices to Keep in Mind

Tata Neu Plus HDFC Bank Credit Card

The Tata Neu Plus HDFC Bank Credit Card offers a host of benefits for customers who love shopping with Tata brands or using UPI for their transactions. Packed with reward programs and exclusive features, this card is a perfect blend of convenience, savings, and lifestyle privileges. Here’s a detailed guide on its features, benefits, and terms.

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Reward Points (NeuCoins)

- NeuCoins Earning

- 2% NeuCoins on Non-EMI spends across Tata Neu and partner Tata brands.

- 1% NeuCoins on Non-Tata brand spends and merchant EMI transactions.

- 1% NeuCoins on UPI spends (maximum of 500 NeuCoins per calendar month).

- Special UPI Benefits (Effective August 1, 2024):

- Earn 0.25% NeuCoins on eligible UPI spends (credited to the card account).

- Additional 0.75% NeuCoins on UPI payments made using the Tata Neu UPI ID (credited to your Tata Neu account).

- Additional Cashback

- After installing the Tata Neu app and creating a NeuPass account, you can earn 5% NeuCoins on a few categories on the Tata Neu website or app. (From January 15, 2025, this will apply only for transactions done via the primary cardholder’s mobile number).

- Caps on NeuCoins

- NeuCoins on utility transactions: Capped at 2,000 per calendar month.

- NeuCoins on telecom and cable transactions: Capped at 2,000 per calendar month.

- Grocery transactions: Capped at 1,000 NeuCoins per month.

- UPI spends: Maximum 500 NeuCoins per calendar month.

- Exclusions

- NeuCoins are not earned on rental, government-related transactions, or education payments through third-party apps.

Read Also: Steps to Apply for a PAN Card Online and Offline

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Additional Features

- Zero Lost Card Liability

- Report a lost card immediately, and you’ll have zero liability for any fraudulent transactions.

- Interest-Free Credit

- Enjoy up to 50 days of interest-free credit on purchases (subject to merchant charge submission).

- Lounge Access

- Four complimentary domestic lounge visits per calendar year (one per quarter).

- Fuel Surcharge Waiver

- 1% waiver on fuel surcharge (minimum transaction of ₹400 and maximum of ₹5,000 per transaction).

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Welcome Benefits

- NeuCoins on First Transaction

- Earn 499 NeuCoins as a reversal of the first-year membership fee.

- NeuCoins will be available on Tata Neu App within 60 days of the first transaction.

- Not applicable for lifetime free or first-year free cards.

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Redemption and Validity of NeuCoins

- Redemption

- Use NeuCoins on Tata Neu App/Website for purchases with brands like Bigbasket, Croma, Westside, Tata CLiQ, IHCL, Air India Express, and more.

- Offline redemption is available at selected stores.

- Validity

- NeuCoins expire 365 days after your last eligible transaction involving earn/use of NeuCoins.

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Eligibility Criteria

For Salaried Individuals

- Age: 21–60 years.

- Minimum monthly income: ₹25,000.

For Self-Employed Individuals

- Age: 21–65 years.

- Minimum ITR: ₹6 lakh per annum.

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Fees and Charges

- Joining/Renewal Fee

- ₹499 plus applicable taxes.

- Renewal fee waived on spends of ₹1,00,000 or more in a year.

- Limited Period Lifetime Free Offer

- Applicable for cards applied between October 1, 2024, and December 31, 2024, via HDFC Bank’s digital platform or physical applications.

Tata Neu Plus HDFC Bank Credit Card: Apply Now

Why Choose the Tata Neu Plus HDFC Bank Credit Card?

This card is an excellent choice for individuals who frequently shop with Tata brands or prefer using UPI for transactions. Its reward programs, lounge access, and fuel surcharge waivers ensure a blend of savings and lifestyle benefits.

HDFC Swiggy Credit Card vs Tata Neu Plus HDFC Bank Credit Card

Apply now and take advantage of the limited-time lifetime free offer to make the most of your spending!